Eligibility

Employers may make application for subsidy under the Subsidy Scheme for the post-transition portion of SP/LSP payable to an employee if:

the employee is covered by the Employment Ordinance (“EO”) (Chapter 57 of the Laws of Hong Kong) and is entitled to SP/LSP under EO upon termination of employment;

the employer is obliged to enrol the employee in an MPF scheme and make contributions to the employee’s MPF account in accordance with the Mandatory Provident Fund Schemes Ordinance (“MPFSO”) (Chapter 485 of the Laws of Hong Kong), or to make contributions to an employer-funded exempt ORS for the employee during the whole or part of the post-transition employment period;

the relevant date of termination of employment of the employee falls within the 25-year subsidy period, i.e. between 1 May 2025 and 30 April 2050 (both dates inclusive); and

the post-transition portion of SP/LSP paid to the employee has not been/will not be fully covered/subsidised by other government funding.

For more information on the eligibility for SP/LSP, please refer to the provisions in Employment Ordinance (“EO”) or Extracts of Provisions in the Employment Ordinance Relating to SP and LSP.

Method of Subsidy

The amount of subsidy payable will be calculated based on the net amount of post-transition portion of SP/LSP actually paid to the employee by the employer or the net amount of post-transition portion of SP/LSP payable as calculated in accordance with EO, whichever is less.

The first subsidy year of SSA is from 1 May 2025 to 30 April 2026, and the second subsidy year from 1 May 2026 to 30 April 2027, and so on and so forth. The subsidy ratio will be determined based on the subsidy year in which the relevant date of termination of the employment falls.

Application Methods

Employers are encouraged to submit online application through TransitionEase to reduce consuming paper and enjoy a more convenient online service. Employers may also use Bulk Application Template to submit up to 30 subsidy applications in one go by simply uploading the completed Template to the TransitionEase. Besides, employers can submit completed application form with a copy of relevant supporting documents by email, facsimile, post or submit in person to the Service Centre for Subsidy Scheme for Abolition of MPF Offsetting Arrangement (“Service Centre”); drop the completed application form to the drop box -

Service Centre

Address: 18/F, Tower A, Manulife Financial Centre, 223 Wai Yip Street, Kwun Tong, Kowloon

Office hours:

Mondays to Fridays (excluding public holidays)

from 10:00 am to 1:00 pm

and

2:00 pm to 7:00 pm

Hotline: 2989 1001

Fax: 2989 1012

Email: enquiry@ssasc.hk

Drop box

Address: 22/F, Prince’s Building, Central, Hong Kong

Opening hours:

Mondays to Fridays (excluding public holidays)

from 8:00 am to 7:00 pm

Application form and Guidance Notes for Employers Making Subsidy Applications can be downloaded from the TransitionEase Portal or obtained from the Service Centre. Please click here to read the relevant leaflet.

Applicant employers should ensure that consent has been obtained from the employee for providing his/her personal data and necessary information and documents for subsidy application.

Deadline to Submit Applications

Employers must submit applications within three months of the date of effecting payment of SP/LSP to the employees concerned. Late applications will NOT be entertained.

Examples

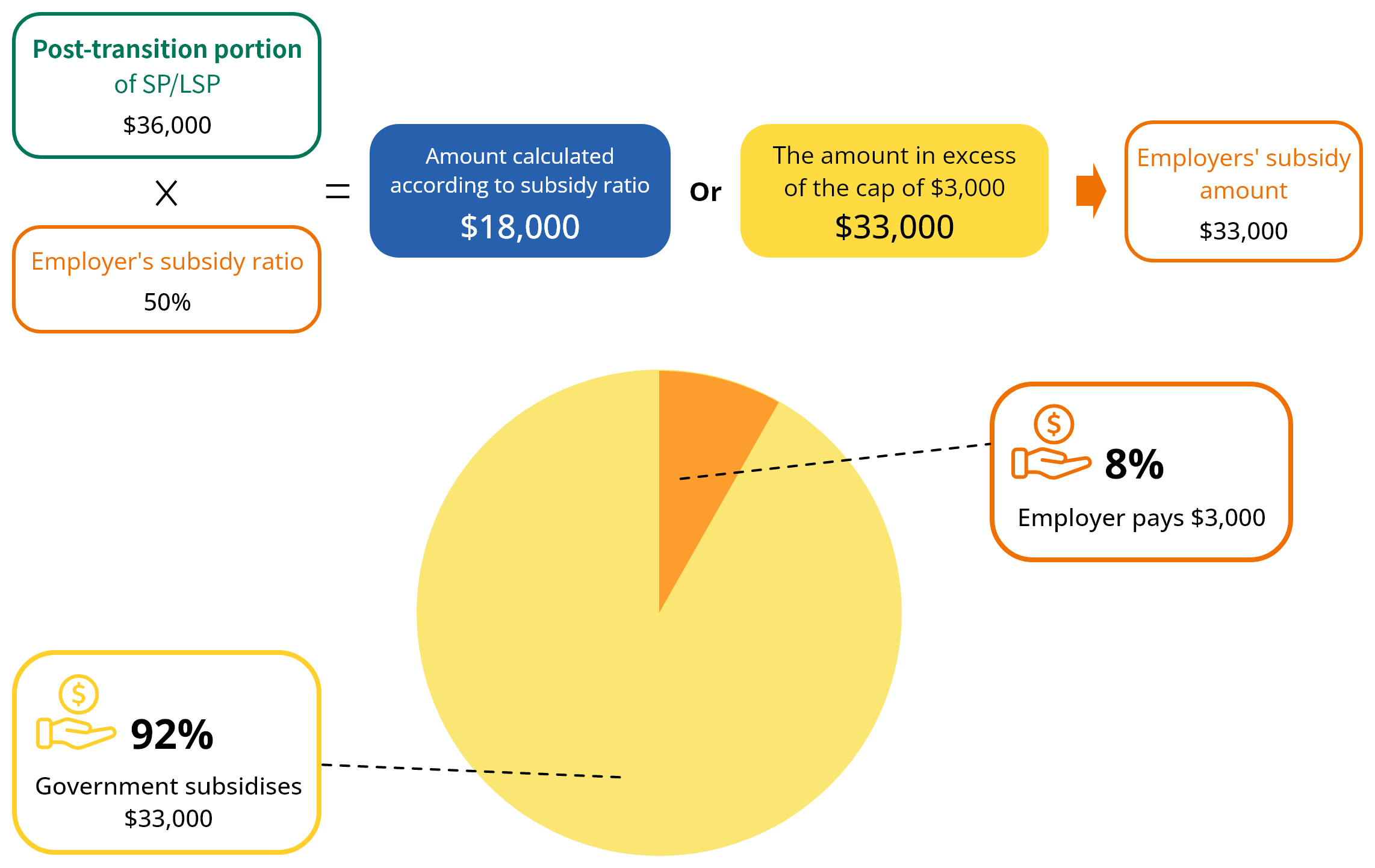

For calculating the subsidy amount payable to employers for subsidy applications falling within the $500,000 threshold, please refer to the subsidy ratio in Table 1:

| Subsidy year | Subsidy ratio in respect of post-transition portion of SP/LSP per employee paid by employers |

|---|---|

| 1 - 3 | 50% or the amount in excess of the cap of $3,000 (whichever is more) |

| 4 | 45% or the amount in excess of the cap of $25,000 (whichever is more) |

Assuming in Year 3 after the abolition

For calculating the subsidy amount payable to employers for subsidy applications falling within the $500,000 threshold, please refer to the subsidy ratio in Table 1

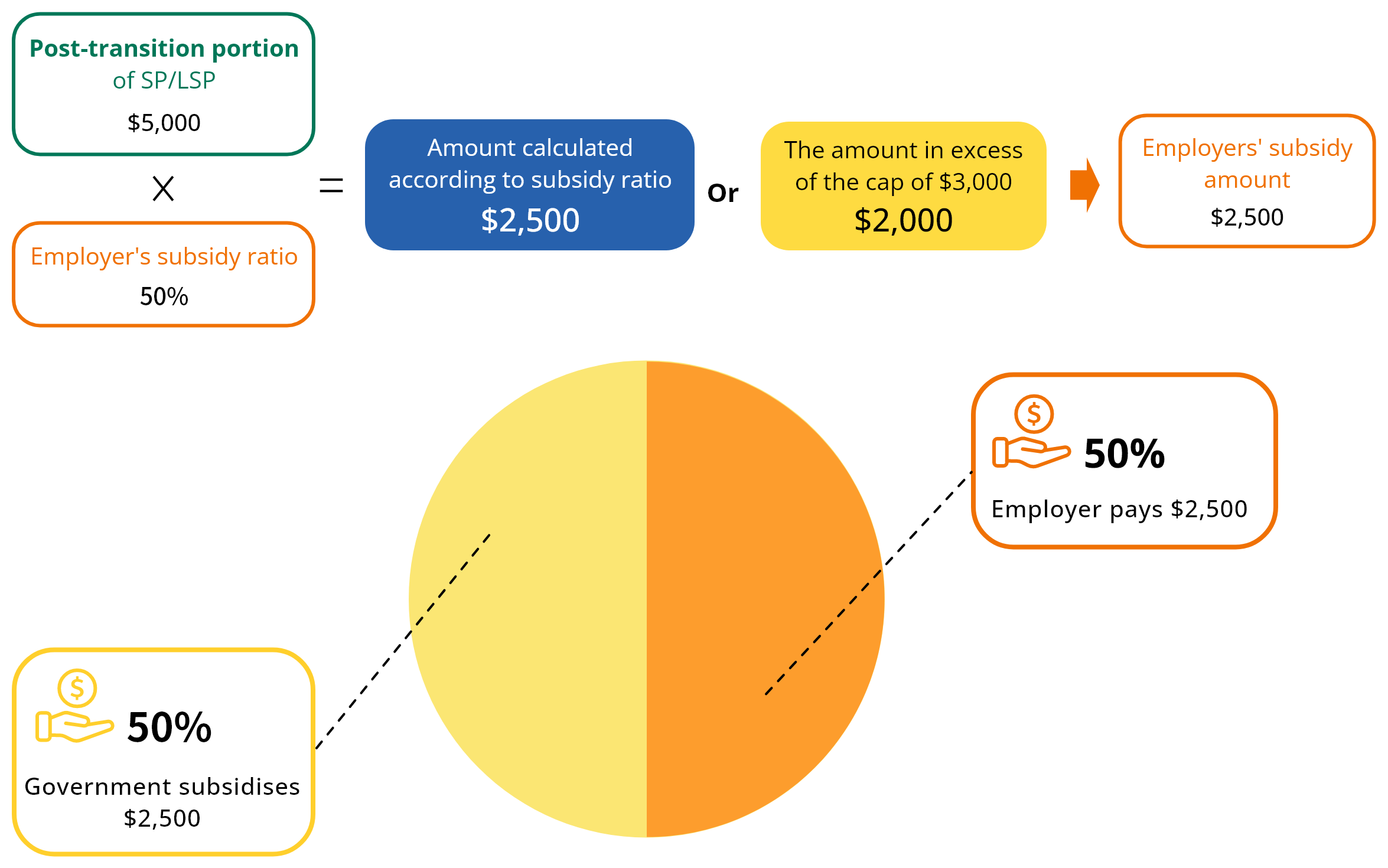

| Subsidy year | Subsidy ratio in respect of post-transition portion of SP/LSP per employee paid by employers |

|---|---|

| 1 - 3 | 50% or the amount in excess of the cap of $3,000 (whichever is more) |

| 4 | 45% or the amount in excess of the cap of $25,000 (whichever is more) |

Assuming in Year 1 after the abolition

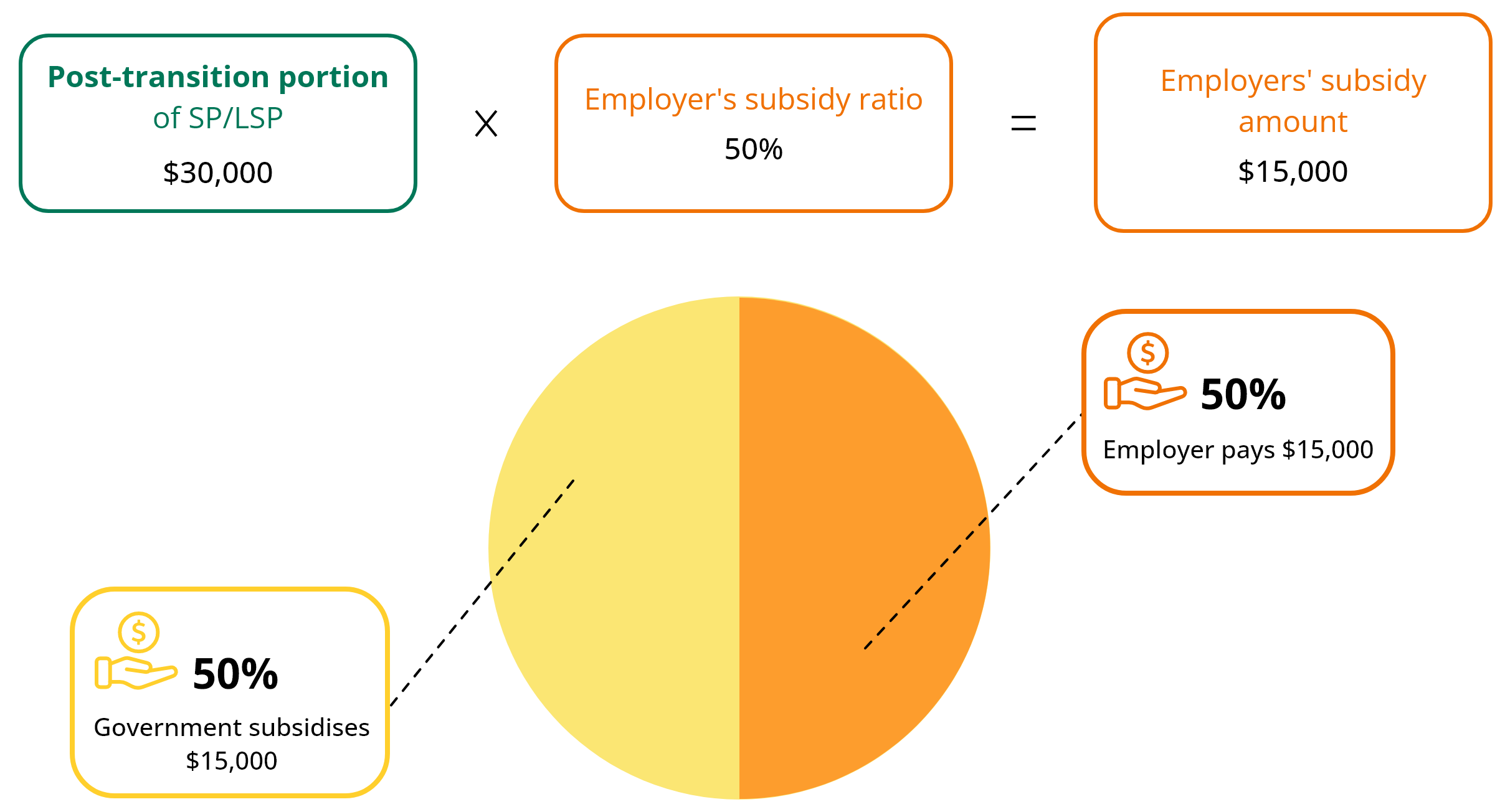

For calculating the subsidy amount payable to employers for subsidy applications beyond the $500,000 threshold, please refer to the subsidy ratio in Table 2.

| Subsidy year | Subsidy ratio in respect of post-transition portion of SP/LSP per employee paid by employers |

|---|---|

| 1 - 3 | 50% |

| 4 | 45% |

Assuming in Year 2 after the abolition

Application Results

In general, employers will be notified of the application result within 30 working days after the Service Centre has received all necessary information and documents pertaining to the applications. The subsidy will be paid into the employer’s specified bank account provided at the time of application.

Audit/Review of Applications

The Service Centre and/or LD will select completed applications for audit/review. Employers of the selected applications may be required to provide further information (e.g. records of employer’s contributions to MPF scheme or MPF-exempted ORS for the employee, etc.). If employers fail to provide the information required without reasonable excuse, they will be liable to repay in full any subsidy received to the Government of the Hong Kong Special Administrative Region.

Under any circumstances, if it is found that the applicant employer is not eligible for subsidy or the eligible amount of subsidy should be lesser than the amount previously approved, the applicant employer shall be required to repay in full the overpaid amount or the Service Centre and/or LD will offset the overpaid amount with the subsidy payable to any approved applications of the employer.