Key points

In tandem with the abolition of the offsetting arrangement under the Mandatory Provident Fund (MPF) System on 1 May 2025, the Labour Department launches the Subsidy Scheme for Abolition of MPF Offsetting Arrangement (SSA).

SSA shares out employers’ expenses on severance payment (SP)/long service payment (LSP) in respect of their employees’ employment period on or after 1 May 2025 onwards (i.e. the post-transition portion of SP/LSP) by providing employers with subsidies for 25 years. The subsidy ratio will be progressively reduced on a year-on-year basis over the subsidy period with a view to helping employers gradually adapt to the policy change.

Key points of the scheme are as follows:

-

The subsidy scheme only covers the post-transition portion of SP/LSP paid to an employee.

-

The subsidy amount will be calculated based on the net amount of post-transition portion of SP/LSP actually paid to an employee by the employer or the net amount of post-transition portion of SP/LSP payable as calculated in accordance with the Employment Ordinance (EO), whichever is less.

-

There will be a specified subsidy ratio in respect of the net amount of post-transition portion of SP/LSP payable to an employee by an employer in each subsidy year.

-

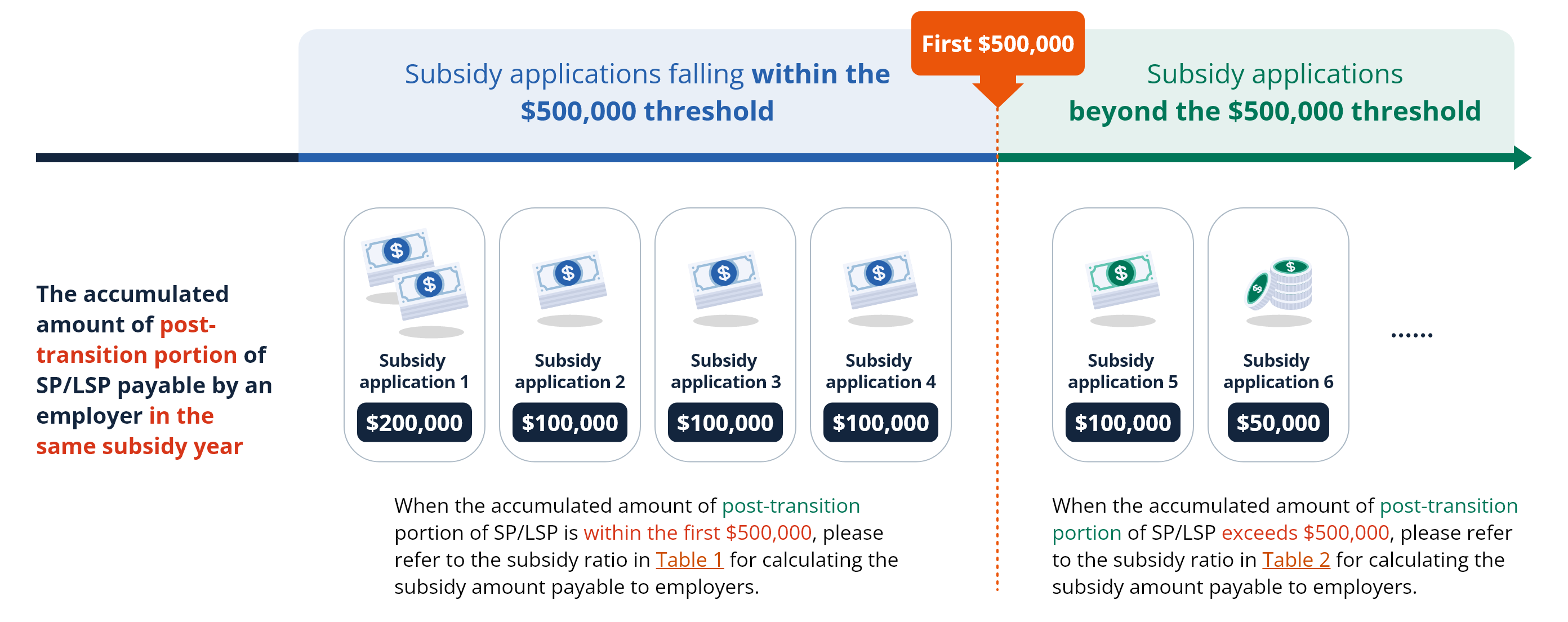

Different subsidy ratios are set for cases falling within the first $500,000 and beyond the first $500,000 of accumulated net amount of post-transition portion of SP/LSP payable by an employer in a subsidy year respectively (i.e. the “$500,000 threshold”)

-

Given that nearly 90% of micro, small and medium-sized enterprises have no more than $500,000 SP/LSP liabilities a year, they will generally be benefited from a higher subsidy for each SP/LSP case within the $500,000 threshold.

What is “$500,000 threshold”?

The $500,000 threshold refers to whether the accumulated amount of post-transition portion of SP/LSP payable by an employer during the same subsidy year exceeds $500,000:

Illustration on the $500,000 threshold under the Subsidy Scheme for Abolition of MPF Offsetting Arrangement

(The above figures are for illustrative purpose only)

The first subsidy year of SSA is from 1 May 2025 to 30 April 2026, and the second subsidy year from 1 May 2026 to 30 April 2027, and so on and so forth. The subsidy ratio will be determined in accordance with the subsidy year in which the relevant date of termination of the employment of the concerned employee falls.

When an application is approved, all approved application(s) (including the previously approved and the newly approved ones) of the employer in the same subsidy year will be sorted in descending order according to the respective net amount of the post-transition portion of SP/LSP eligible for subsidy in order to determine whether the subsidy ratio for applications falling within or beyond the $500,000 threshold should be adopted for calculating the amount of subsidy payable of the newly approved application.

After re-ordering, previously approved application(s) which originally fell within the $500,000 threshold might fall outside the $500,000 threshold and thus the subsidy payable should be re-calculated based on the subsidy ratio applicable to applications beyond the threshold. Subsidy amount payable of all affected applications will be re-calculated. If the subsidy amount in respect of any previously approved application(s) decreases, the overpaid subsidy will be deducted from the subsidy payable to the newly approved application. The subsidy payable to the applicant employer in respect of the newly approved application will be the net subsidy amount after deducting the overpaid subsidy amount of affected applications.

For subsidy applications falling within the $500,000 threshold, please refer to the subsidy ratio in Table 1:

【Table 1】Subsidy applications which fall within the $500,000 threshold

| Subsidy year |

Subsidy ratio in respect of post-transition portion of SP/LSP |

|---|---|

| 1 – 3 | 50% or the amount in excess of the cap of $3,000 (whichever is more) |

| 4 | 45% or the amount in excess of the cap of $25,000 (whichever is more) |

| 5 | 40% or the amount in excess of the cap of $25,000 (whichever is more) |

| 6 | 35% or the amount in excess of the cap of $25,000 (whichever is more) |

| 7 | 30% or the amount in excess of the cap of $50,000 (whichever is more) |

| 8 | 25% or the amount in excess of the cap of $50,000 (whichever is more) |

| 9 | 20% or the amount in excess of the cap of $50,000 (whichever is more) |

| 10 – 11 | 20% |

| 12 – 13 | 15% |

| 14 – 19 | 10% |

| 20 – 25 | 5% |

For subsidy applications beyond the $500,000 threshold, please refer to the subsidy ratio in Table 2:

【Table 2】Subsidy applications which go beyond the $500,000 threshold

| Subsidy year |

Subsidy ratio in respect of post-transition portion of SP/LSP |

|---|---|

| 1 – 3 | 50% |

| 4 | 45% |

| 5 | 40% |

| 6 | 35% |

| 7 | 30% |

| 8 | 25% |

| 9 | 20% |

| 10 | 15% |

| 11 | 10% |

| 12 | 5% |

| 13 - 25 | 0% |

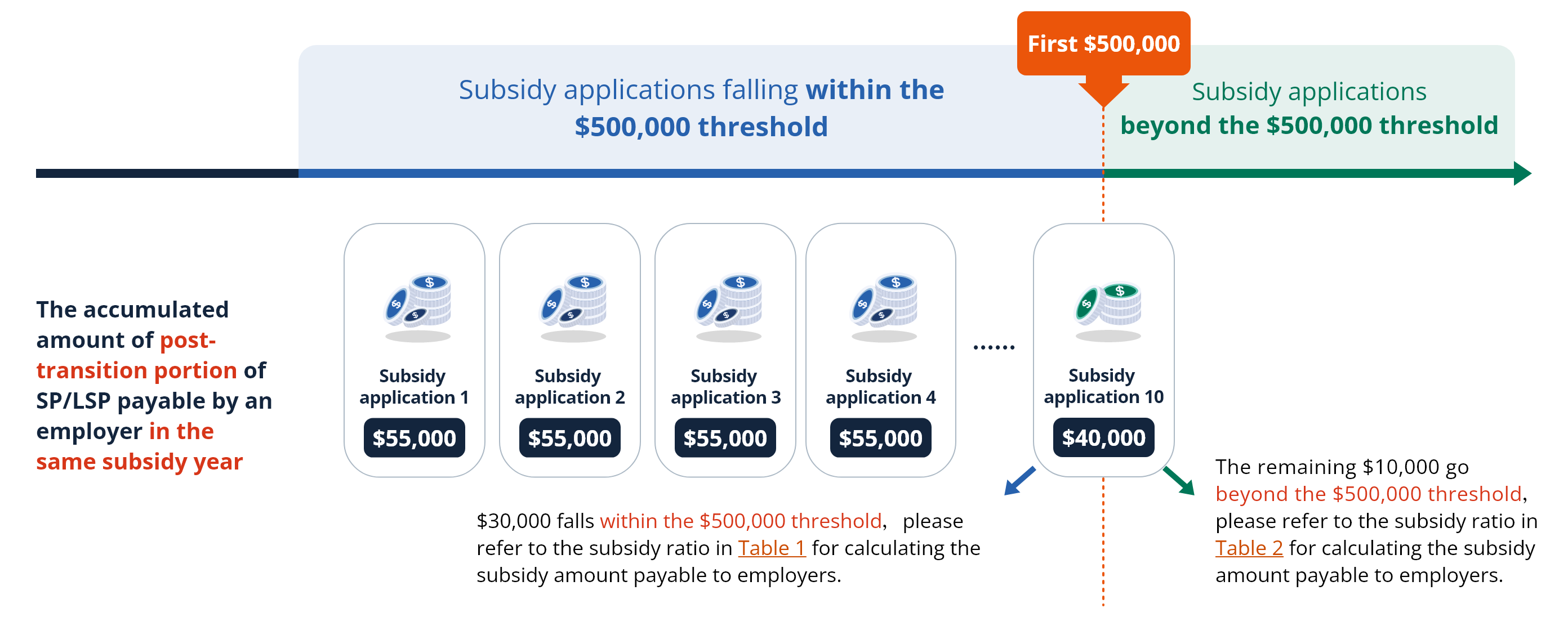

For cases straddling the $500,000 threshold, SP/LSP within the $500,000 threshold will be calculated according to the higher subsidy ratio in Table 1, with “capped amount” calculated on a pro rata basis, whilst the remaining part exceeding the $500,000 threshold will be calculated according to the lower subsidy ratio in Table 2.

For example, assuming an employer has already paid post-transition portion of SP/LSP for 9 employees totaling $470,000 in Year 3 after the abolition, when the employer has to pay $40,000 post-transition portion of SP/LSP to the 10th employee, $30,000 of which will fall within the $500,000 threshold and the remaining $10,000 will go beyond the threshold. The amount payable by the employer under the Subsidy Scheme for Abolition of MPF Offsetting Arrangement is calculated as follow:

Zoom(The above figures are for illustrative purpose only)

The subsidy amount for employers under the Subsidy Scheme for Abolition of MPF Offsetting Arrangement is calculated as follow:

-

Subsidy amount for the $30,000 post-transition portion of SP/LSP expenses falls within the $500,000 threshold:

$30,000 × 50% subsidy ratio = $15,000 or

$30,000 – $2,250 pro-rata “capped amount”* = $27,750, whichever is more.* According to Table 1, the “capped amount” is $3,000 for applications falling within the $500,000 threshold in Subsidy Year 3. Since only part of the SP/LSP expenses of this application falls within the $500,000 threshold, a pro-rata “capped amount” will be applied (i.e. $3,000 (the capped amount) x $30,000 (the amount of SP/LSP within the $500,000 threshold) ÷ $40,000 (the total amount of SP/LSP) = $2,250).

-

Subsidy amount for the $10,000 post-transition portion of SP/LSP expenses beyond the $500,000 threshold:

$10,000 × 50% subsidy ratio = $5,000 -

The total subsidy amount payable to the employer for post-transition of SP/LSP expenses:

$27,750 + $5,000 = $32,750