Eligibility

Upon abolition of the MPF offsetting arrangement on 1 May 2025 (i.e. “transition date”), employers are no longer allowed to use the employer-funded (mandatory) MPF scheme benefits or the employer-funded (basic portion) exempt occupational retirement scheme (“ORS”) benefits (i.e.“carved-out benefits”) to offset an employee’s severance payment (“SP”)/long service payment (“LSP”) in respect of the employee’s employment period from 1 May 2025 onwards (i.e. “ post-transition portion of SP/LSP”).

After abolition of the MPF offsetting arrangement, the SP/LSP entitlement for employees to whom the abolition applies and whose employment straddles 1 May 2025 is divided into two portions, namely the pre-transition portion of SP/LSP (i.e. SP/LSP in respect of the employee’s employment period before 1 May 2025) and the post-transition portion of SP/LSP. Due to the change in calculation of the SP/LSP entitlement, some of these employees may receive less aggregate benefits than what they would have received if the MPF offsetting arrangement had not been abolished (here below referred to as “worse-off” employees). The Government has undertaken to make up for the shortfall in aggregate benefits of the “worse-off” employees.

Employees who consider submitting a shortfall application are advised to complete the “Preliminary Self-assessment Checklist”to preliminarily self-assess whether they are “worse-off” employees. You can also make use of the online calculating tool “EasyCal" on the website to calculate if you would receive less aggregate benefits than what you would have received if the MPF offsetting arrangement had not been abolished.

Employees to whom the abolition of the MPF offsetting arrangement applies refer to those whose employers are obliged to enrol them in an MPF scheme in accordance with the Mandatory Provident Fund Schemes Ordinance (“MPFSO”) (Chapter 485 of the Laws of Hong Kong) and make contributions for them; or to make contributions to an employer-funded exempt occupational retirement scheme (“ORS”) for them. An employer-funded exempt ORS refers to:

an ORS that is granted exemption under MPFSO;

the provident fund schemes under the Grant Schools Provident Fund Rules (Chapter 279C of the Laws of Hong Kong) and the Subsidized Schools Provident Fund Rules (Chapter 279D of the Laws of Hong Kong); or

a provident, pension, retirement or superannuation scheme (however described) of a place outside Hong Kong to which an employer has made contributions for an employee (including an imported worker) and due to which, the employer is exempted from arranging the employee to enrol in an MPF scheme in Hong Kong.

For more information on the eligibility for SP/LSP, please refer to the provisions in Employment Ordinance (“EO”) or Extracts of Provisions in the Employment Ordinance Relating to SP and LSP.

Application Methods

“Worse-off” employees could submit a completed application form with a copy of relevant supporting documents by email, facsimile, post or submit in person to the Service Centre for Subsidy Scheme for Abolition of MPF Offsetting Arrangement (“Service Centre”); drop the completed application form to the drop box -

Service Centre

Address: 18/F, Tower A, Manulife Financial Centre, 223 Wai Yip Street, Kwun Tong, Kowloon

Office hours:

Mondays to Fridays (excluding public holidays)

from 10:00 am to 1:00 pm

and

2:00 pm to 7:00 pm

Hotline: 2989 1001

Fax: 2989 1012

Email: enquiry@ssasc.hk

Drop box

Address: 22/F, Prince’s Building, Central, Hong Kong

Opening hours:

Mondays to Fridays (excluding public holidays)

from 8:00 am to 7:00 pm

Application form and Guidance Notes for Making Subsidy Applications for Shortfall in Aggregate Benefits can be downloaded from the TransitionEase Portal or obtained from the Service Centre. Please click here to read the relevant leaflet.

Applicants may be requested to provide supplementary information during application processing where necessary.

After receipt of your subsidy application, the Abolition of Offsetting Subsidy Service Centre will further assess whether there is any shortfall in your aggregate benefits and whether you are eligible for subsidy to make up for the shortfall in aggregate benefits.

Deadline to Submit Applications

Applicants must submit applications within six months after the following dates:

After the date of receipt of SP/LSP payment;

After the date of receipt of the ex gratia payment for employees who are defaulted payment of SP by their employers and are granted ex gratia payment of SP from the Protection of Wages on Insolvency Fund (“PWIF”);

For employees who are defaulted payment of SP/LSP by their employers but are not eligible to apply to PWIF: The due date of payment as stated in the award/order of SP/LSP obtained from the Labour Tribunal/court in their favour; or the date of the employer signing a statement of inability to pay, whichever is later.

Late applications will NOT be entertained.

Examples of Subsidy Calculation

Employees can apply for subsidy for shortfall in aggregate benefits if they receive less aggregate benefits after the abolition of the MPF offsetting arrangement than what they would have received if the MPF offsetting arrangement had not been abolished. Aggregate benefits of an employee after the abolition of the MPF offsetting arrangement mean:

After offsetting (if any) with SP/LSP -

-

Any employer-funded MPF scheme benefits remaining^; and/or

-

Any vested employer-funded ORS benefits remaining; and/or

-

net amount of gratuities receivable

* The amount referred to the SP/LSP amount received by an employee from his/her employer, or the amount calculated in accordance with EO after offsetting with the allowable offsetting item(s) (if any), whichever is higher.

^ Employer-funded MPF scheme benefits include both employer-funded (mandatory) MPF scheme benefits (here below referred to as “ERMC”) and employer-funded (voluntary) MPF scheme benefits (here below referred to as “ERVC”) (if any).

Irrespective of whether the employer had used the employer-funded MPF benefits/ORS benefits/contractual gratuities (if any) to offset an employee’s SP/LSP after the abolition of the MPF offsetting arrangement, the Service Centre would use these benefits (if available) to offset the employee’s SP/LSP to derive the employee’s aggregate benefits under the “no-abolition” regime as illustrated in the examples below.

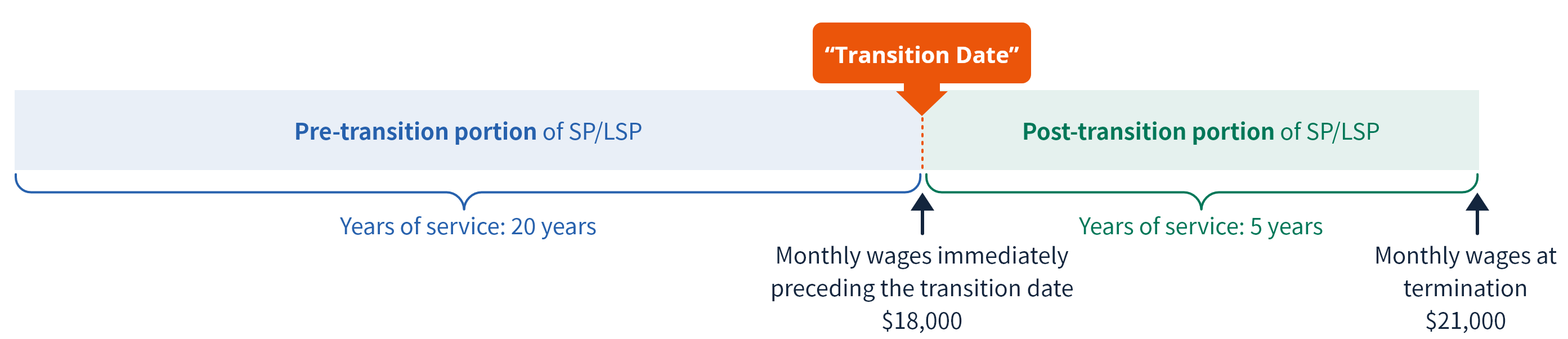

Examples 1 to 2 below, assume that the employees (“EEs A and B”) had been employed for 20 years before the transition date (i.e. 1 May 2025) and were dismissed after 25 years of service. Their monthly wages immediately preceding the transition date were $18,000 while the monthly wages immediately preceding the termination of employment were $21,000 as illustrated below:

The employees’ SP/LSP if the MPF offsetting arrangement had not been abolished and after the abolition are calculated as follows:

SP/LSP entitlement

| If there had been no abolition | $21,000 × 2/3 × 25 years of service | $350,000 | |

|---|---|---|---|

| After the abolition | Pre-transition period | Post-transition period | Total: $310,000 |

|

$18,000 × 2/3 × 20 years of service = $240,000 |

$21,000 × 2/3 × 5 years of service = $70,000 |

||

Assuming that the amount of ERMC of EE A at the time of dismissal was $279,000, EE A’s aggregate benefits if the MPF offsetting arrangement had not been abolished and after the abolition are set out as follows:

| SP/LSP entitlement (a) |

ERMC+ available for offsetting with SP/LSP (b) |

Remaining ERMC after offsetting SP/LSP (c) |

Aggregate benefits | |||

|---|---|---|---|---|---|---|

| If there had been no abolition | $350,000 | $279,000 | $0* |

$350,000 [(a)+(c)] |

||

| After the abolition |

Pre-transition

period (a1) |

Post-transition

period (a2) |

Pre-transition period | Post-transition period | $39,000% |

$349,000 [(a1)+(a2)+(c)] |

| $240,000 | $70,000 | $279,000 | No offsetting by ERMC allowed | |||

| Amount of shortfall in aggregate benefits |

$1,000 (i.e. $350,000 − $349,000) |

|||||

| + | If the MPF offsetting arrangement had not been abolished, ERMC can be used to offset the SP/LSP entitlement for whole employment period. After the abolition of the MPF offsetting arrangement, ERMC can only be used to offset the pre-transition portion of SP/LSP. |

| * | The Service Centre would use the whole amount of ERMC ($279,000) to offset EE A’s SP/LSP to derive EE A’s aggregate benefits under the “no-abolition” regime. |

| % | The employer had used part of the ERMC to offset the pre-transition portion of SP/LSP ($240,000). The remaining ERMC is $39,000 (i.e. $279,000 − $240,000). |

Assuming that the amount of ERMC of EE B at the time of dismissal is $279,000, calculation of EE B’s aggregate benefits if the MPF offsetting arrangement had not been abolished and after the abolition are set out as follows:

| SP/LSP entitlement (a) |

ERMC+ available for

offsetting with SP/LSP (b) |

Remaining

ERMC

after offsetting

SP/LSP (c) |

Aggregate benefits | |||

|---|---|---|---|---|---|---|

| If there had been no abolition | $350,000 | $279,000 | $0* |

$350,000 [(a)+(c)] |

||

| After the abolition |

Pre-transition

period (a1) |

Post-transition

period (a2) |

Pre-transition period | Post-transition period | $279,000^ |

$589,000 [(a1)+(a2)+(c)] |

| $240,000 | $70,000 | $279,000 | No offsetting by ERMC allowed | |||

| Amount of shortfall in aggregate benefits |

$0 (because $350,000 − $589,000 < $0) |

|||||

| + | If the MPF offsetting arrangement had not been abolished, ERMC can be used to offset the SP/LSP entitlement for whole employment period. After the abolition of the MPF offsetting arrangement, ERMC can only be used to offset the pre-transition portion of SP/LSP. |

| * | The Service Centre would use all ERMC available ($279,000) to offset EE B’s SP/LSP to derive EE B’s aggregate benefits under the “no-abolition” regime. |

| ^ | The employer did not use ERMC to offset SP/LSP and the whole amount of ERMC ($279,000) remains in EE B’s MPF account. |

Application Results

In general, applicants will be notified of the application result within 30 working days via post after the Service Centre has received all necessary information and documents pertaining to the applications. The subsidy will be paid into the applicants’ specified bank account provided at the time of application.

Audit/Review of Applications

The Service Centre and/or LD will select applications of which processing has been completed for review. Where necessary, applicants of the selected applications will be required to provide further information to substantiate their applications. If applicants fail to provide the information required without reasonable excuse, they will be liable to repay in full any subsidy received to the Hong Kong Special Administrative Region (“HKSAR”) Government.

In addition, if it is later found that an applicant is not eligible for subsidy or for whatever reasons, the amount of subsidy for which the applicant is eligible should be smaller than the amount paid to the applicant, the applicant shall repay in full to the HKSAR Government any overpaid subsidy received. The Service Centre and LD reserves the right to have the overpaid subsidy set off against part or all of the subsidy approved in any applications of the applicants concerned.